- Aatmnirbhar Bharat Rojgar Yojana

- January 16, 2021

There are mainly three steps involved while taking the benefit under the ABRY Scheme

- Employer Registration

To avail the benefit granted under Atma Nirbhar Rojgar Yojana(ABRY), First the establishment is to be registered under ABRY and declaration by the employer need to be filed and separate declaration to be filed online in case the establishment is a contractor establishment or manpower supplier. The same will be done through the option Establishment Registration in the ABRY Menu in the employer portal. Before Registration of the establishment, the employer should ensure the submission of the Return of ownership i.e. Form 5A online.

- Member Registration

After the successful registration of the establishment, the eligible employees are also required to be registered. And the Registration can be done online in the Member Registration option in the ABRY Menu in the Unified Employer Portal. A text file containing the Universal Account Numbers of the eligible employee need to be uploaded.

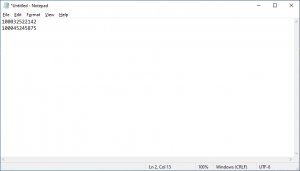

How to prepare Text file for Member Registration

Open a Blank document in Notepad

Write the UAN of the eligible employees in the format depicted. Save and Upload the file in the member Registration

ECR Filing

ECR Text file need to be prepared as usual and be uploaded in the portal for the preparation of challan. The Central Govt. subsidy in respect of eligible employees will automatically be deducted from the amount of total challan of EPF and the challan for the balance amount need to be paid. The challan thus prepared will show the subsidy amount due for Central Government and the amount payable by the employer separately.

For claiming the benefit under this Scheme, the ECR has to be filed within 60 day of the close of the wage month. The establishment is liable to pay the Interest under Section 7Q on such belated remittances. The employer will not make any deduction of employee share in respect of the eligible employees from the wages.

ABRY Scheme Details

First of all, take a look at, What is Aatm Nirbhar Bharat Rojgar Yojana

Atma Nirbhar Bharat Rozgar Yojana has been introduced under the Atma Nirbhar Bharat Abhiyan to incentivise the creation of new employment opportunities during the COVID-19 recovery phase to those who have lost their job during the Lockdown Period.

In this Scheme, The Central Govt. will Pay the Employees’ share as well as Employers’ share of EPF Contribution or only the Employees’ share depending on the Strength of the establishment.

Validity of Scheme

The Scheme will commence from 1st October, 2020 and the last date of Registration of Eligible member or employees will be 30th June 2021. The Benefit will be granted to eligible employees for a period 24 months.

Reference Base

Let us first understand, what is Reference Base and how we calculate the reference Base for an establishment.

For every establishment, a Reference Base is set. So the establishment is eligible for benefits to be granted under this Scheme with respect to that Reference Base. Generally, that reference base is number of EPF members in the ECR filed for the month of September 2020.

In case, where the ECR for the month of September 2020 is filed later than its due date but before 15th of December 2020, the Reference Base would be the number of employees as shown in the ECR for the month of September 2020 or the number of employees as per last ECR filed which is filed on or before 11th November 2020, whichever is higher.

For establishment that are newly covered with the EPFO between the period 1st October 2020 to 30th June 2021, the reference base of employees is considered as Zero.

Eligibility Criteria for establishment

The establishment who have already been registered with the EPFO :-

If the Reference Base of employee is less than or equal to Fifty, that establishment should employ minimum two employees above the reference Base. For the establishment having reference base of employee greater than fifty, such establishment should employ minimum five eligible employees above the reference base. Such already registered establishment must continue to maintain minimum number of additional eligible employees in addition to retaining the number of employees as reference base.

In the case of establishment which has been covered voluntary under Section 1(4) after 01/10/2020 with employees less than twenty, such establishment would not exit from such coverage and the employees who are the beneficiaries of the scheme are not allowed to make final withdrawals until the expiry of the period of two years after the validity period of this Scheme.

For the establishment that are working as contractors or engaged in Manpower supply to more than one principal employer, such contractor establishment cannot claim any benefit of employer’ share if the benefit has been claimed by the Principal employer.

Registration of New Employee

Let us know, who is a new employee according to definition of Atma Nirbhar Rojgar Yojana. A new employee is an employee drawing wages less than 15000 per month

- The employee should have valid Universal Account Number seeded with Aadhaar.

- Who was not working in any establishment and have not got any Universal Account Number prior to 1st October 2020 and who joins any Employment on or after 1st October 2020 to 30th June 2021 and get his Aadhaar validated Universal Account Number.

- The benefit to the eligible members will be given to maximum 24 months from the date of registration.

- The employee will become ineligible if at any point of time, his monthly salary exceeds 14999/- per month.

- If any employee is already availing benefit under PMRPY(Pradhan Mantri Rojgar Protsahan Yojana) , such employee will not eligible to avail the benefit under ABRY.

Quantum of benefit

For establishment which are employing 1000 contributory member of EPF as per ECR for September 2020, the Central Government will pay the subsidy of total employee and employer share i.e. 24% of the wages of the eligible employees. In a case where the strength of contributory members exceeds 1000 in such establishment, such establishment will continue to get the benefit of 24% of wages during the Scheme period.

In case, the establishment are employing more than 1000 contributory members for September 2020, the Central Government will pay the subsidy of only employee share i.e. 12% of the wages of the eligible employees.

Post Comment